The stock market is one of the most exciting and lucrative ways to invest your money. But it can also be intimidating and confusing for beginners who don’t know where to start. How do you choose the right stocks, analyze them, and build a diversified portfolio? How do you avoid common mistakes and pitfalls that can cost you money and opportunities? And how do you keep learning and improving your stock market skills?

If you are interested in learning about the stock market and how to invest your money wisely, you have come to the right place. I have been a professional trader and investor for over 10 years, and I have personally experienced the ups and downs of the market. I have also taught thousands of people how to trade and invest successfully through my online courses, books, and podcasts. In this article, I will share with you some of the best books for stock market beginners that can help you learn and master the art and science of stock market investing.

What is the Stock Market and How Does it Work?

Before you start investing in the stock market, you need to understand what it is and how it works. The stock market is a place where buyers and sellers trade shares of companies. A share is a unit of ownership in a company that gives you a claim on its assets and profits. The price of a share depends on the supply and demand of the market, as well as the performance and prospects of the company. The stock market is divided into different segments, such as indices, sectors, industries, and exchanges. You can buy and sell shares through a broker or an online platform.

Some of the benefits of investing in the stock market are:

- You can earn income from dividends, which are payments made by companies to their shareholders from their profits.

- You can gain capital appreciation, which is the increase in the value of your shares over time.

- You can diversify your portfolio, which means spreading your money across different types of investments to reduce your risk.

- You can participate in the growth and innovation of various businesses and industries.

Some of the risks of investing in the stock market are:

- You can lose money if the price of your shares goes down below what you paid for them.

- You can face volatility, which is the fluctuation in the price of your shares due to various factors such as news, events, earnings, etc.

- You can incur fees, taxes, and commissions that can reduce your returns.

- You can encounter frauds, scams, or manipulation that can affect the integrity and fairness of the market.

Therefore, investing in the stock market requires knowledge, skills, discipline, and patience. You need to do your research and analysis before buying or selling any shares. You also need to have a clear strategy, goal, and plan for your investments. And you need to monitor your performance and adjust your portfolio accordingly.

Why Should You Invest in the Stock Market?

Investing in the stock market can offer several benefits, such as:

- Growing your wealth over time

- Beating inflation and preserving your purchasing power

- Diversifying your portfolio and reducing your risk

- Participating in the growth and innovation of various businesses and industries

- Earning income from dividends and capital appreciation

- Having liquidity and flexibility to buy and sell shares easily

However, investing in the stock market also involves some challenges and risks, such as:

- Losing money if the price of your shares goes down below what you paid for them

- Facing volatility and uncertainty due to various factors that affect the market

- Incurring fees, taxes, and commissions that can reduce your returns

- Encountering frauds, scams, or manipulation that can affect the integrity and fairness of the market

- Dealing with emotional ups and downs that can affect your decision making

Therefore, investing in the stock market requires knowledge, skills, discipline, and patience. You need to do your research and analysis before buying or selling any shares. You also need to have a clear strategy, goal, and plan for your investments. And you need to monitor your performance and adjust your portfolio accordingly.

How to Choose the Right Stocks for Your Portfolio?

One of the most important decisions you need to make as an investor is which stocks to buy and hold in your portfolio. There are thousands of stocks available in the market, but not all of them are worth investing in. You need to do your research and analysis to find the best stocks that suit your risk appetite, investment horizon, and objectives. Some of the factors you need to consider when choosing stocks are:

The financial performance and health of the company

You want to invest in companies that have strong and consistent earnings, revenue, cash flow, and profitability. You also want to avoid companies that have too much debt, low liquidity, or high operating costs. You can use various financial ratios to measure and compare the financial performance and health of different companies, such as:

- Earnings per share (EPS): This is the amount of profit that a company earns for each share of its stock. A higher EPS indicates a more profitable company.

- Price-to-earnings ratio (P/E): This is the ratio of the current stock price to the EPS. A lower P/E indicates a cheaper valuation, but it may also reflect a lower growth potential or a higher risk.

- Return on equity (ROE): This is the ratio of the net income to the shareholders’ equity. A higher ROE indicates a more efficient use of capital and a higher return for investors.

- Debt-to-equity ratio (D/E): This is the ratio of the total debt to the total equity. A lower D/E indicates a lower financial leverage and a lower risk of default.

The growth potential and competitive advantage of the company

You want to invest in companies that have a strong growth potential and a competitive advantage over their rivals. You also want to avoid companies that face stiff competition, regulatory hurdles, or technological disruptions. You can use various indicators to measure and compare the growth potential and competitive advantage of different companies, such as:

- Revenue growth: This is the percentage increase or decrease in the sales of a company over a period of time. A higher revenue growth indicates a higher demand for the products or services of the company and a larger market share.

- Earnings growth: This is the percentage increase or decrease in the profits of a company over a period of time. A higher earnings growth indicates a higher profitability and a better management of costs and expenses.

- Market capitalization: This is the total value of all the shares of a company in the market. A higher market capitalization indicates a larger size and influence of the company in its industry.

- Competitive moat: This is the ability of a company to maintain or increase its market share and profitability by creating barriers to entry for its competitors. A competitive moat can be based on factors such as brand loyalty, economies of scale, network effects, patents, or innovation.

The valuation and dividend yield of the stock

You want to invest in stocks that are undervalued or fairly valued based on their intrinsic worth and future prospects. You also want to avoid stocks that are overvalued or speculative based on their hype or momentum. You can use various methods to estimate and compare the valuation of different stocks, such as:

- Discounted cash flow (DCF): This is a method that calculates the present value of all the future cash flows that a company will generate for its shareholders. A higher DCF indicates a higher intrinsic value of the stock.

- Relative valuation: This is a method that compares the valuation ratios of a stock with those of its peers or industry averages. A lower relative valuation indicates a cheaper price compared to similar stocks.

- Dividend yield: This is the ratio of the annual dividend per share to the current stock price. A higher dividend yield indicates a higher income return for investors.

The industry trends and outlook

You want to invest in stocks that belong to industries that have favorable trends and outlooks for their growth and profitability. You also want to avoid stocks that belong to industries that have unfavorable trends and outlooks for their decline or disruption. You can use various sources to monitor and analyze the industry trends and outlooks, such as:

- News reports: These are articles or stories that cover the latest developments, events, or issues that affect an industry or its participants. News reports can provide insights into the opportunities and challenges that an industry faces.

- Industry reports: These are publications or studies that provide comprehensive information and analysis on an industry or its segments. Industry reports can provide data on the size, structure, performance, trends, drivers, barriers, competitors, customers, regulations, innovations, and forecasts of an industry.

- Expert opinions: These are views or recommendations from professionals or experts who have knowledge or experience in an industry or its related fields. Expert opinions can provide guidance on the best practices, strategies, techniques, tips, and pitfalls for investing in an industry.

By considering these factors, you can narrow down your choices and select the right stocks for your portfolio. However, you should not rely on any single factor or method alone. You should use a combination of different factors and methods to evaluate and compare different stocks. You should also update your research and analysis regularly to keep track of any changes or developments that may affect your investment decisions.

How to Analyze Stocks Using Fundamental and Technical Analysis?

Stock analysis is the process of evaluating and comparing different stocks based on various criteria, such as performance, value, growth, risk, and potential. Stock analysis can help investors make informed and rational decisions about buying, selling, or holding stocks. There are two main methods of stock analysis: fundamental analysis and technical analysis.

Fundamental analysis

Fundamental analysis is the method of analyzing a stock based on its intrinsic value, which is the true worth of the company behind the stock. Fundamental analysis involves examining the financial statements, earnings, revenue, cash flow, profitability, growth, dividends, and competitive advantage of the company. Fundamental analysis also considers the industry trends, economic conditions, market sentiment, and future prospects of the company.

The goal of fundamental analysis is to determine whether a stock is undervalued or overvalued based on its intrinsic value. An undervalued stock is one that is trading below its intrinsic value, which means that it has a higher potential for appreciation. An overvalued stock is one that is trading above its intrinsic value, which means that it has a lower potential for appreciation or a higher risk of decline.

Some of the tools and techniques used in fundamental analysis are:

- Financial ratios: These are numerical values that measure and compare various aspects of a company’s financial performance and health, such as profitability, efficiency, liquidity, solvency, growth, and valuation. Some of the common financial ratios are earnings per share (EPS), price-to-earnings ratio (P/E), return on equity (ROE), debt-to-equity ratio (D/E), dividend yield, and free cash flow.

- Financial statements: These are documents that provide detailed information about a company’s financial activities and position, such as income statement, balance sheet, cash flow statement, and statement of shareholders’ equity. Financial statements can help investors understand how a company generates revenue, incurs expenses, manages assets and liabilities, distributes profits, and invests for growth.

- Discounted cash flow (DCF): This is a method that estimates the present value of all the future cash flows that a company will generate for its shareholders. DCF can help investors determine the intrinsic value of a stock by discounting the expected cash flows by an appropriate rate of return.

- Relative valuation: This is a method that compares the valuation ratios of a stock with those of its peers or industry averages. Relative valuation can help investors determine whether a stock is cheap or expensive compared to similar stocks.

Technical analysis

Technical analysis is the method of analyzing a stock based on its price movements and patterns. Technical analysis involves studying the historical and current data of a stock’s price, volume, momentum, trend, support, resistance, and indicators. Technical analysis also considers the psychological factors that influence the market behavior, such as emotions, expectations, and opinions.

The goal of technical analysis is to identify and exploit the price trends and turning points of a stock. A price trend is the general direction in which a stock’s price is moving over time. A turning point is a point where a stock’s price changes its direction or reverses its trend. A technical analyst uses various tools and techniques to spot and follow the price trends and turning points of a stock.

Some of the tools and techniques used in technical analysis are:

- Charts: These are graphical representations of a stock’s price movements over time. Charts can help investors visualize the price patterns and trends of a stock. There are different types of charts, such as line charts, bar charts, candlestick charts, point-and-figure charts, etc.

- Patterns: These are recognizable shapes or formations that appear on charts. Patterns can help investors predict the future price movements or signals of a stock. There are different types of patterns, such as reversal patterns, continuation patterns, breakout patterns, etc.

- Indicators: These are mathematical calculations or formulas that derive from a stock’s price or volume data. Indicators can help investors measure and evaluate various aspects of a stock’s price behavior, such as strength, direction, momentum, volatility, etc. There are different types of indicators, such as trend indicators, momentum indicators, oscillators, volume indicators, etc.

Both fundamental analysis and technical analysis have their own advantages and disadvantages. Fundamental analysis can provide a deeper understanding of a company’s business model, quality, and value, but it can also be time-consuming, complex, and subjective. Technical analysis can provide a simpler and faster way to identify and exploit the price opportunities and signals of a stock, but it can also be unreliable, inconsistent, and self-fulfilling. Therefore, investors should use both methods to complement each other and get a more comprehensive and balanced view of a stock.

How to Build a Diversified and Balanced Portfolio?

A diversified and balanced portfolio is one that consists of different types of assets that have different risk and return characteristics. The purpose of diversification is to reduce the overall risk of the portfolio by spreading the money across various investments that are not highly correlated with each other. The purpose of balance is to optimize the performance and returns of the portfolio by adjusting the allocation of assets according to the investor’s goals, time horizon, and risk tolerance.

Some of the benefits of having a diversified and balanced portfolio are:

- It can help you achieve your financial goals by providing a mix of growth, income, and stability.

- It can help you cope with market fluctuations by reducing the impact of any single asset class or sector on your portfolio.

- It can help you avoid emotional biases and behavioral mistakes by following a disciplined and systematic approach to investing.

Some of the steps to build a diversified and balanced portfolio are:

Determine your risk profile

Your risk profile is a measure of how much risk you are willing and able to take with your investments. It depends on factors such as your age, income, expenses, savings, liabilities, goals, time horizon, and personality. You can use various tools and questionnaires to assess your risk profile and find out your risk appetite (how much risk you want to take), risk capacity (how much risk you can afford to take), and risk tolerance (how much risk you can handle emotionally).

Choose your asset allocation

Your asset allocation is the percentage of your portfolio that you invest in different asset classes, such as stocks, bonds, cash, real estate, commodities, etc. Your asset allocation should reflect your risk profile and your expected returns. Generally, stocks are considered more risky but offer higher returns than bonds, while cash is considered less risky but offers lower returns than bonds. You can use various models and strategies to choose your asset allocation, such as:

- The rule of thumb: This is a simple formula that suggests subtracting your age from 100 or 120 and investing that percentage in stocks, and the rest in bonds. For example, if you are 40 years old, you can invest 60% or 80% in stocks, and 40% or 20% in bonds.

- The strategic asset allocation: This is a long-term approach that involves setting a target asset allocation based on your risk profile and expected returns, and sticking to it regardless of market conditions. You can periodically rebalance your portfolio to maintain your target asset allocation.

- The tactical asset allocation: This is a short-term approach that involves adjusting your asset allocation based on market trends and opportunities. You can use various indicators and signals to identify when to increase or decrease your exposure to certain asset classes or sectors.

Select your investments

Once you have decided on your asset allocation, you need to select the specific investments that will make up your portfolio. You can choose from various types of investments, such as individual stocks or bonds, mutual funds, exchange-traded funds (ETFs), index funds, etc. You should consider various factors when selecting your investments, such as:

- The performance and track record of the investment

- The fees and expenses associated with the investment

- The diversification and correlation of the investment with other investments in your portfolio

- The tax implications and benefits of the investment

Monitor and review your portfolio

After you have built your portfolio, you need to monitor and review it regularly to ensure that it is performing well and meeting your goals. You should check the performance of your portfolio against relevant benchmarks and compare it with your expectations. You should also evaluate the risk and return characteristics of your portfolio and see if they match your risk profile. You should also consider any changes in your personal or financial situation that may affect your goals or preferences.

If you find any deviations or discrepancies in your portfolio, you may need to rebalance it or make some adjustments. Rebalancing is the process of restoring your portfolio to its original or desired asset allocation by buying or selling some investments. Rebalancing can help you maintain your risk level and capture the gains from different asset classes. You should rebalance your portfolio at least once a year or whenever there is a significant change in your asset allocation.

By following these steps, you can build a diversified and balanced portfolio that can help you achieve your financial goals with an optimal level of risk and return. However, building a diversified and balanced portfolio is not a one-time task. It requires constant monitoring, review, and adjustment to keep up with the changing market conditions and personal circumstances. Therefore, you should always seek professional advice or guidance if you are not sure how to build or manage your diversified and balanced portfolio.

How to Avoid Common Mistakes and Pitfalls in Stock Market Investing?

Stock market investing is not without its challenges and risks. Many beginners make common mistakes that can cost them money and opportunities. Some of these mistakes are:

- Investing without a plan or a goal

- Following the crowd or the media hype

- Chasing high returns or low prices

- Buying or selling based on emotions or impulses

- Ignoring fees, taxes, and inflation

- Not doing enough research or due diligence

- Not reviewing or rebalancing your portfolio regularly

To avoid these mistakes, you need to have a clear strategy, discipline, patience, and education. You also need to learn from your own experiences and from other successful investors. Here are some tips and advice on how to avoid common mistakes and pitfalls in stock market investing:

Investing without a plan or a goal

One of the biggest mistakes that investors make is investing without a plan or a goal. A plan or a goal helps you define your purpose, direction, and expectations for your investments. It also helps you measure your progress and performance. Without a plan or a goal, you may end up investing randomly, inconsistently, or aimlessly.

To avoid this mistake, you need to have a clear plan or a goal for your investments. You need to answer questions such as:

- Why are you investing?

- What are your financial goals and objectives?

- How much money do you have to invest?

- How much risk are you willing and able to take?

- How long do you want to invest for?

- How will you monitor and evaluate your investments?

By having a clear plan or a goal, you can invest with more confidence, clarity, and focus.

Following the crowd or the media hype

Another common mistake that investors make is following the crowd or the media hype. The crowd or the media hype refers to the popular opinions, trends, or sentiments that influence the market behavior. Following the crowd or the media hype can lead to irrational decisions, herd mentality, or FOMO (fear of missing out).

To avoid this mistake, you need to think independently and critically. You need to do your own research and analysis before buying or selling any stocks. You need to avoid being swayed by emotions, rumors, or biases. You need to base your decisions on facts, logic, and evidence.

Chasing high returns or low prices

Another common mistake that investors make is chasing high returns or low prices. Chasing high returns means investing in stocks that have already risen significantly in price, hoping that they will continue to rise. Chasing low prices means investing in stocks that have already fallen significantly in price, hoping that they will rebound. Both strategies can be risky and unprofitable.

To avoid this mistake, you need to have realistic expectations and valuations. You need to understand that past performance is not indicative of future results. You need to avoid being greedy or fearful. You need to buy stocks based on their intrinsic value and growth potential, not based on their price movements.

Buying or selling based on emotions or impulses

Another common mistake that investors make is buying or selling based on emotions or impulses. Emotions or impulses are feelings or urges that affect your judgment and decision making. Some of the common emotions or impulses that investors face are:

- Greed: This is the desire to make more money or profit from your investments.

- Fear: This is the aversion to lose money or suffer losses from your investments.

- Regret: This is the sorrow or disappointment for making a wrong decision or missing an opportunity.

- Pride: This is the satisfaction or ego for making a right decision or achieving a result.

Emotions or impulses can cloud your rationality and objectivity. They can make you overconfident, overreactive, or indecisive.

To avoid this mistake, you need to control your emotions and impulses. You need to have a disciplined and systematic approach to investing. You need to follow your plan and strategy, not your feelings or instincts. You need to review your decisions and learn from your mistakes.

Ignoring fees, taxes, and inflation

Another common mistake that investors make is ignoring fees, taxes, and inflation. Fees are the costs associated with buying or selling stocks, such as commissions, spreads, brokerage fees, etc. Taxes are the levies imposed by the government on your income or capital gains from your investments. Inflation is the general increase in the prices of goods and services over time.

Fees, taxes, and inflation can reduce your returns and erode your purchasing power. They can also affect your investment decisions and strategies.

To avoid this mistake, you need to be aware of fees, taxes, and inflation. You need to minimize your fees by choosing low-cost brokers or platforms. You need to optimize your taxes by choosing tax-efficient investments or accounts. You need to beat inflation by choosing investments that offer higher returns than the inflation rate.

Not doing enough research or due diligence

Another common mistake that investors make is not doing enough research or due diligence. Research or due diligence is the process of gathering and analyzing information about a company, its industry, its competitors, its financials, its valuation, its prospects, etc. Research or due diligence helps you evaluate and compare different stocks and make informed and rational decisions.

Not doing enough research or due diligence can lead to poor investment choices, missed opportunities, or unexpected risks.

To avoid this mistake, you need to do enough research or due diligence. You need to use various sources and methods to collect and verify information about different stocks. You need to use both fundamental analysis and technical analysis to evaluate and compare different stocks. You need to update your research or due diligence regularly to keep track of any changes or developments.

Not reviewing or rebalancing your portfolio regularly

Another common mistake that investors make is not reviewing or rebalancing their portfolio regularly. Reviewing your portfolio means checking the performance, risk, and return of your investments against your goals, expectations, and benchmarks. Rebalancing your portfolio means adjusting the allocation of your investments according to your plan, strategy, and risk profile.

Not reviewing or rebalancing your portfolio regularly can lead to deviation, imbalance, or inefficiency in your portfolio. It can also affect your ability to achieve your goals or optimize your returns.

To avoid this mistake, you need to review and rebalance your portfolio regularly. You need to monitor the performance, risk, and return of your investments at least once a year or whenever there is a significant change in your plan, strategy, or risk profile. You need to rebalance your portfolio by buying or selling some investments to restore your desired asset allocation.

By avoiding these common mistakes and pitfalls in stock market investing, you can improve your chances of success and profitability. You can also learn from other successful investors who have shared their insights and experiences in various books. Some of the best books for stock market beginners that can help you avoid common mistakes and pitfalls are:

- The Intelligent Investor by Benjamin Graham

: This is a classic book that teaches the principles of value investing and how to avoid emotional errors in the stock market.

- The Little Book of Common Sense Investing by John C. Bogle: This is a simple book that explains the benefits of index investing and how to avoid unnecessary fees and taxes in the stock market.

- One Up On Wall Street by Peter Lynch: This is an entertaining book that shares the secrets of a legendary fund manager and how to avoid following the crowd or the media hype in the stock market.

- The Psychology of Money by Morgan Housel: This is a modern book that explores the behavioral aspects of investing and how to avoid irrational decisions or impulses in the stock market.

How to Keep Learning and Improving Your Stock Market Skills?

Stock market investing is a continuous learning process. You need to keep yourself updated with the latest news, trends, developments, and opportunities in the market. You also need to keep track of your own performance, strengths, weaknesses, and areas of improvement. You can use various resources to enhance your knowledge and skills, such as:

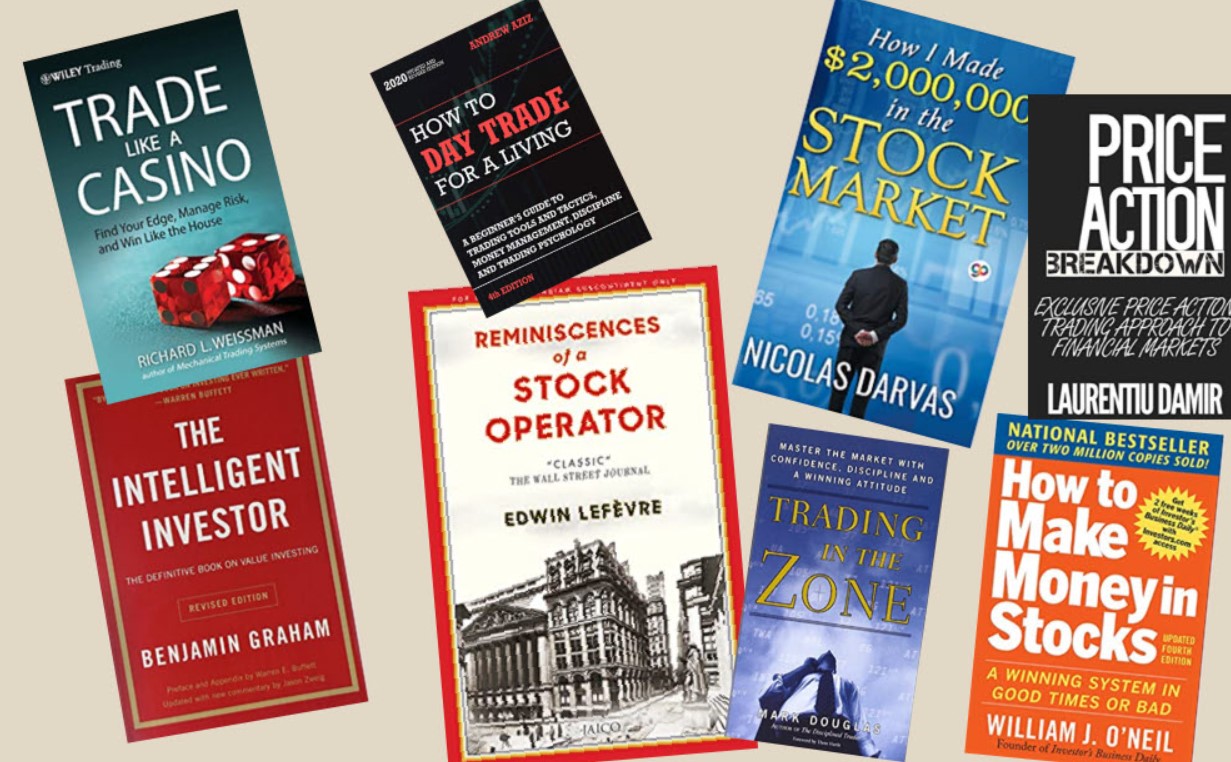

- Books: Reading books by successful investors, traders, or experts can help you learn from their insights, experiences, and strategies. Books can also provide you with comprehensive information and analysis on various topics related to the stock market, such as fundamentals, technicals, psychology, risk management, etc. Some of the best books for stock market beginners are:

- The Intelligent Investor by Benjamin Graham: This is a classic book that teaches the principles of value investing and how to avoid emotional errors in the stock market.

- The Little Book of Common Sense Investing by John C. Bogle: This is a simple book that explains the benefits of index investing and how to avoid unnecessary fees and taxes in the stock market.

- One Up On Wall Street by Peter Lynch: This is an entertaining book that shares the secrets of a legendary fund manager and how to avoid following the crowd or the media hype in the stock market.

- The Psychology of Money by Morgan Housel: This is a modern book that explores the behavioral aspects of investing and how to avoid irrational decisions or impulses in the stock market.

- Blogs: Following blogs by reputable sources or influencers can help you stay updated with the current events, opinions, or tips that affect the stock market. Blogs can also provide you with timely and relevant information and analysis on various stocks, sectors, industries, or markets. Some of the best blogs for stock market beginners are:

- The Motley Fool: This is a popular blog that provides stock recommendations, investing advice, financial news, and analysis for individual investors.

- Seeking Alpha: This is a crowdsourced blog that features articles, podcasts, newsletters, and research reports from various contributors on stocks, markets, and investing strategies.

- Investopedia: This is an educational blog that offers articles, videos, courses, quizzes, and tutorials on various topics related to finance, economics, and investing.

- Trading View: This is a social network blog that allows users to share and discuss their trading ideas, charts, indicators, and signals on stocks, forex, cryptocurrencies, and other markets.

- Podcasts: Listening to podcasts by knowledgeable hosts or guests can help you learn from their conversations, interviews, or stories about the stock market. Podcasts can also provide you with useful insights, tips, or recommendations on various aspects of investing, such as strategies, techniques, tools, resources, etc. Some of the best podcasts for stock market beginners are:

- We Study Billionaires: This is a podcast that features discussions and analysis on the investing habits and philosophies of some of the world’s most successful investors.

- Moneycontrol Podcast: This is a podcast that covers the latest news and views on business, economy, markets, personal finance, startups, etc.

- Chat With Traders: This is a podcast that features interviews with professional traders who share their stories, lessons, challenges, successes, etc.

- The Investors Podcast Network: This is a network of podcasts that offer various shows on topics such as value investing, real estate investing, bitcoin investing, millennial investing, etc.

- Courses: Taking courses by qualified instructors or institutions can help you acquire or improve your knowledge and skills on the stock market. Courses can also provide you with structured and interactive learning experiences that can test your understanding and application of various concepts or techniques. Some of the best courses for stock market beginners are:

- Stock Market Investing for Beginners: This is an online course by Udemy that teaches the basics of stock market investing, such as how to open an account, how to place orders, how to analyse stocks, how to build a portfolio, etc.

- Stock Market From Scratch for Complete Beginners: This is an online course by Skillshare that teaches the fundamentals of stock market investing, such as how to read financial statements, how to use valuation methods, how to diversify your portfolio, etc.

- Stock Trading & Investing for Beginners 4-in-1 Course Bundle: This is an online course by Wealthy Education that teaches four different aspects of stock trading and investing, such as technical analysis, fundamental analysis, dividend growth investing, and value investing.

- NSE Academy Certified Capital Market Professional (E-NCCMP): This is an online course by NSE Academy that provides a comprehensive and practical knowledge of the capital market, such as equity, derivatives, mutual funds, currency, etc.

- Webinars: Attending webinars by experienced speakers or experts can help you learn from their presentations, demonstrations, or Q&A sessions on the stock market. Webinars can also provide you with live and interactive learning opportunities that can address your queries or doubts on various topics or issues. Some of the best webinars for stock market beginners are:

- How to Start Investing in Stock Market: This is a webinar by Elearnmarkets that introduces the basics of stock market investing, such as how to open a demat and trading account, how to select a broker, how to place orders, how to use trading platforms, etc.

- Stock Market 101: Everything You Need to Know About Buying, Selling and Trading: This is a webinar by TheStreet that explains the essentials of stock market investing, such as how to read stock quotes, how to use stock charts, how to research stocks, how to diversify your portfolio, etc.

- How to Trade Stocks for Beginners: This is a webinar by Warrior Trading that teaches the basics of stock trading, such as how to find stocks to trade, how to use technical analysis, how to manage risk and reward, how to develop a trading plan, etc.

- How to Invest in Stock Market for Beginners: This is a webinar by Zerodha that covers the fundamentals of stock market investing, such as how to analyse companies, how to value stocks, how to use financial ratios, how to build a portfolio, etc.

The more you learn, the more confident and competent you will become as an investor. You should always seek professional advice or guidance if you are not sure how to invest in the stock market. You should also practice and apply what you learn in a simulated or real environment. By doing so, you will be able to improve your performance and results in the stock market.

The more you learn, the more confident and competent you will become as an investor.